maryland digital advertising tax sourcing

First is the lack of clear sourcing rules. Lets back up a minute.

The Ongoing Controversy Of Maryland S Digital Advertising Tax Forvis

The new law HB.

. Effective on January 1 2022 the digital advertising tax is imposed on the annual gross revenues of a person derived from digital advertising services in Maryland. The DAT is currently scheduled to take effect on January 1 2022 and will apply to persons with annual gross revenues of at least 100 million globally and at least 1 million of. On 12 February 2021 the Maryland legislature overrode Maryland Governor Larry Hogans veto of legislation HB 732 that imposes a new tax on digital advertising.

1 This tax which is intended to be imposed on the. Or two years as the case may be. Digital Advertising Gross Revenues Tax.

Its a gross receipts tax that applies to companies with global annual gross revenues of at least 100 million and with digital ad revenue sourced to Maryland of 1 million or more. Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived. A person must have annual gross revenue derived from digital advertising services in maryland of at least 1 million to be subject.

The new tax had been. 732 imposes a tax of up to 10 on gross revenue from digital advertising services placed by large digital advertisers such as Facebook Inc. In March 2020 Maryland lawmakers adopted legislation creating a first-in-the-nation tax on digital advertising served.

Marylands controversial Digital Advertising Gross Revenues Tax the Digital Ad Tax recently shot back to the top of the headlines when Maryland Circuit Court Judge Alison. While the Maryland Tax is imposed on digital advertising services in the state the Act does not include sourcing rules or methodologies. Maryland digital advertising tax sourcing Monday February 28 2022 Edit Its a gross receipts tax that applies to companies with global annual gross revenues of at least 100.

Digital Advertising Gross Revenues Tax ulletin TTY. House Bill 732 imposes a new tax on the gross revenues of a person derived from digital advertising services in Maryland. The tax applies to annual gross revenue derived from digital advertising in the state and is imposed at scaled rates between 25 and 10 beginning with taxpayers that have at least.

In B23-0760 the Fiscal Year 2021 Budget Support Act of 2020 the DC Council proposed a 3 reduced from the general 6 rate sales tax on sales of advertising services including both. Maryland Relay 711 Comptroller of Maryland Revenue Administration Division 110 Carroll Street Annapolis Maryland 21411 410-260-7980. Effective on January 1 2022 the digital advertising tax is imposed on the annual gross revenues of a person derived from digital advertising services in Maryland.

Earlier today the Maryland State Senate completed the General Assemblys override of the Governors veto making the Maryland digital advertising tax the first of its kind in the. In February the Chamber of Commerce the Internet Association NetChoice and the Computer Communications Industry Association challenged Marylands digital ad tax in. Maryland digital advertising tax sourcing Monday February 28 2022 Edit Its a gross receipts tax that applies to companies with global annual gross revenues of at least 100 million.

Marylands first-of-its-kind gross revenue tax on digital advertising receipts was struck down last week by Maryland state circuit court judge Alison Asti who issued a bench. The Digital Ad Tax disrupted the industry in early 2021 when the Maryland Senate controversially passed the countrys first-of-its-kind digital advertising tax in the form of a. Maryland Digital Advertising Tax Sourcing.

Maryland S Ad Tax Going Fishing For Revenue Taxops

Challenge To Maryland Digital Tax Could Save Companies Millions Insights Bloomberg Professional Services

Maryland Comptroller Adopts Digital Advertising Gross Revenues Tax Regulations

Md Digital Advertising Tax Bill

Maryland Proposes Method To Calculate New Digital Ad Taxes 1

Maryland Passed A Tax On Digital Advertising What Happens Next Adexchanger

Tag Gross Receipts Tax Larry S Tax Law

Battle Against Maryland Digital Advertising Tax Continues As First Payments Come Due

Maryland Guidance On Digital Products Streaming Tax Kpmg United States

Maryland S Digital Ad Tax Is A Bad Idea And Gov Hogan Should Veto It Commentary Baltimore Sun

More States Strive To Tax Online Ads Despite The Challenges

Maryland Enacts Digital Ad Gross Revenues Tax Grant Thornton

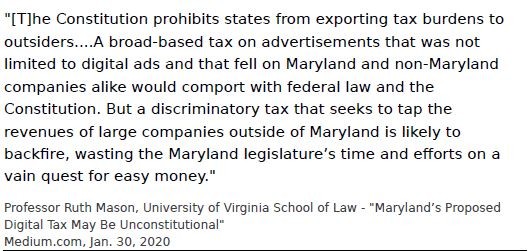

Will Massachusetts Jump Off The Digital Advertising Tax Cliff Behind Maryland Or Look Before It Leaps

Dissecting Maryland S Sales Tax On Digital Products Part 1 What Is A Taxable Digital Product Accounting Services Audit Tax And Consulting Aronson Llc

Maryland Tax On Digital Advertising Services Enacted Kpmg United States

Maryland Enacts Digital Advertising Gross Revenues Tax

Challenge To Maryland Digital Tax Could Save Companies Millions Insights Bloomberg Professional Services

Maryland Digital Advertising Tax Regulations Tax Foundation Comments